Yep – its true. Most of the investing stuff you see out there is nonsense. I’m mainly referring to the news, investing email newsletters, a lot of what’s on YouTube…

Most news outlets “game-ify” investing to keep it interesting. And by that I mean that they talk incessantly about the next hot stock or rare earth metal to invest in. This is all in the effort to make it entertaining rather than factual. They also sensationalise the crashes in the market to make them sound like the end of the world.

…of course, not ALL resources out there are like that (there’s the 1% in there which are keeping it real imho)

The truth on investing is actually kind of boring and repetitious (…and it doesn’t exactly make for exciting content to keep saying the same message over and over again – but Im gonna say it anyway 👀)

The thing is – the “boring” strategies that require not much effort when they are set up are actually some of the most effective. And over time have made many people wealthy.

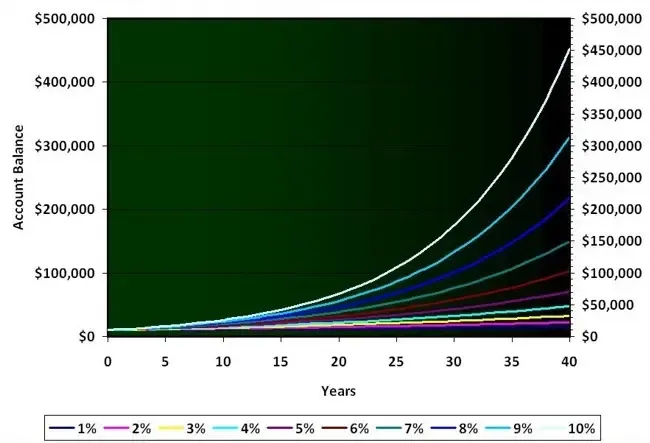

Below is a chart of SPY which is the biggest ETF of the S&P500 (in simple terms – its a chart that displays the price of America’s stock market over time)

You can see here that it hit a new all time high literally today. You can also see on the chart a common trend and that it has steadily increased in value consistently since the 1990’s (the full chart goes back to the 1950s). Of course their is some volatility in there but zoom out far enough and they just look like blips

There’s a saying in investing which I really like:

“The declines are temporary yet the advances are permanent”

Anybody, who has bought a decent fund that reflects the world stock market and just held on long enough will beat the vast majority of professional investors. And better yet it requires little to no effort to do this – apart from just a little education.

Yes, it really can be that simple

But of course there is a little bit more to it than what the character limit of this post will permit me… So defo not one to rush off and buy based on what I’ve said here. And there are certain situations where this philosophy doesn’t apply. So its good to either read around the subject of finance or consult a professional adviser if uncertain. But from what I have seen this strategy and information has a role to play in the vast majority of portfolios.

Anyways – this post is just to draw attention to this phenomenon. It was a seriously huge realisation for me back in the day. It definitely caused me to begin digging deeper.

Hope it inspires some more people on their investing journey going forwards 📈

Enter your details above to receive a link you can use to download your FREE pdf

Read More

Here's What New Associates Need To Know

What Is Your Definition Of Retirement?

How Often Do You Look Back On Your Life And Think “I Wish That I Knew Than What I Know Now?”

Can I Invest In My ISA For Passive Income?

The Role Of Luck In Investing