In part 1 we dealt with this subject from a philosophical perspective… this time we review this question more from a “logistical” perspective. By this I mean the hard truths of what someone can do to achieve this sooner.

Retirement is in essence the point of financial freedom. The point at which work becomes OPTIONAL and not a necessity. The conventional wisdom is that this takes a long time. Actually, this is NOT necessarily true – if somebody somewhere has achieved early retirement then we know it must be possible. And as such the question more becomes “how can this be done?” rather than “can this be done?”

You see retirement is more related to cashflow and having enough of it to live the lifestyle that we want with the amount of money we require to do this. Many consider that when ones cashflow is generated in a purely passive way to be the point of “retirement”. But this is problematic for a few reasons – here are three big ones:

- It assumes that we just want to sit around all day and do nothing while money rolls in (anyone remember how boring lockdown was for most? I don’t think this is actually a reality many would wish for should they achieve it)

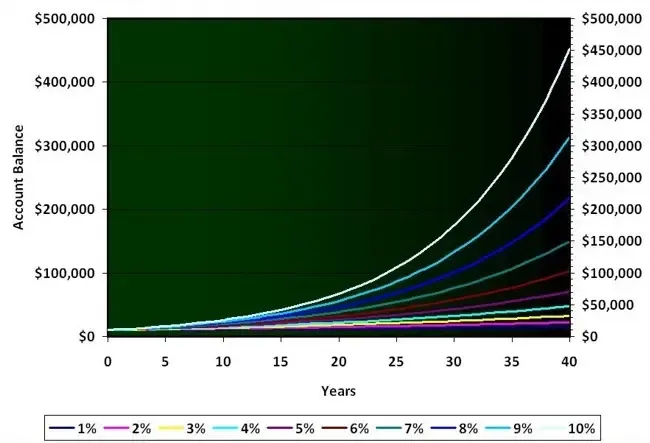

- Using a conventional portfolio of stocks/bonds this takes many decades to achieve (this is why many think it takes many years – its mainly a reflection of how these specific assets work more than anything else. They are far from the only assets available)

- We can delay the point at which we give ourselves permission to be happy to some stage in the future. We end of forever chasing this mirage which can take the majority of our life. Better to give ourselves “permission” to be happy in the here and now so to speak.

The thing that really gets me is that this means that many place a false set of goalposts when it comes to their investing objectives. We futurise unnecessarily the point at which we can be financially free

Anyway, this article is not meant to cause anyone to question their life decisions – more to inspire and demonstrate what is possible.

Really hope it provides some food for thought.

- James

Feel free to pick up the book “How Much Money Do I Need To Retire?” by Todd Tressider for an interesting discussion on this subject

Enter your details above to receive a link you can use to download your FREE pdf

Read More

Here's What New Associates Need To Know

What Is Your Definition Of Retirement?

How Often Do You Look Back On Your Life And Think “I Wish That I Knew Than What I Know Now?”

Can I Invest In My ISA For Passive Income?

The Role Of Luck In Investing