Passive Income is something many are striving for. A lot of people want the passive income lifestyle of little work and all play. (or maybe just slightly less work and slightly more FUN)

But what actually is passive income? – lets conceptualise it. Passive income is defined as money which consistently appears in our bank account without us necessarily working for it. This may supplement or replace our income… For example, if you work 4 days we a week you may earn £10,000 a month as a dentist AND have an additional £2,000 a month from passive (also known as “residual”) sources.

So how do we obtain the £2,000 from “residual sources.” Well we need to invest in some assets of course. Fundamentally, there are four different types of asset – we need to understand each one to make the correct choice to obtain “passive income”.

Below are the four types of asset:

- Lifestyle Assets Lifestyle assets are assets that hold value however we can only release that stored value when we sell them. They do not tend to throw off any residual (passive) income. The classic lifestyle asset is our house. Houses are great and it is amazing to have a nice home however we can only unlock any wealth stored within our house when we downsize or remortgage. They also do not throw off any yield therefore they generate no residual income to reinvest.

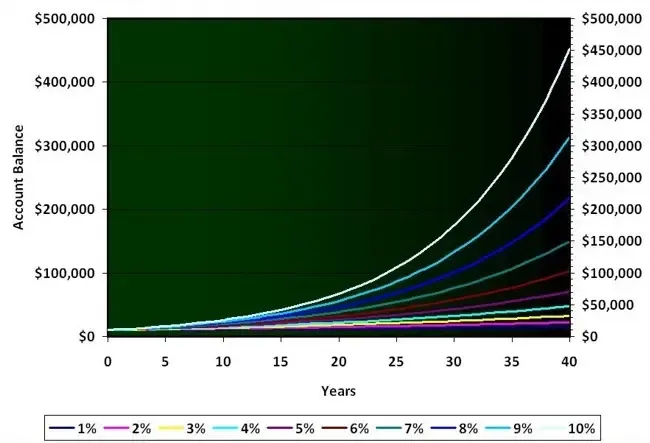

- Growth Assets Growth assets are designed to appreciate in value. They may or may not throw off residual income. The whole point in growth assets is that their growth in value outpaces inflation therefore compounding with time. The higher the growth the sooner the compounding. Purchasing certain stocks, funds or even Bitcoin can be examples of growth assets. Of course this must be executed correctly with the correct knowledge to be successful. This is of course not financial advice and should one feel uncertain please consult an advisor. The thing I often see is people purchasing stocks in the hope of generating passive (residual) income. Whilst this can be done they are most effectively used in a “buy and hold” style. This would mean REINVESTING the profits to maximise compounding. Siphoning off profits for short term gain delays this process and means that we are postponing the point that we can become financially free. This can set back this process for several years.

- Cash Flow Assets These are assets that are orientated towards throwing off a residual income. A good example of this is property.Whilst property can be leveraged to great success typically the yields are 6 – 8% a year meaning that it takes a serious amount of capital to create income that will replace what we can earn 9-5. Also it is worth noting that property is fairly heavily taxed and often requires the use of debt as leverage.

- Business Assets A Business asset is basically a collection of systems or processes which allows one to generate value for others. When this is done in a consistent way – a business is created. This is the true way of generating residual income in the sense most conceive it. Of course it means a lot of work – however the rewards can be huge. If one TRULY wants residual income then it is the way to go.

So of the 4 types of asset only CASH FLOW and BUSINESS assets have the potential to generate passive income. Now with both there types of asset it certainly doesn’t happen overnight. Setting up a business is NOT EASY. Acquiring businesses or “cash flow assets” (property) requires the use of significant amounts of debt. Not everyone is comfortable with this.

So you may be wondering “But what is the easiest way of obtaining passive income?” Assets are certainly not an easy way of doing it… however it can be done with time. Let's go back to our first example of the dentist who earns £10k in 4 days a week and £2k from other sources… How about if they earned £12k a week or more from their 4 days a week in dentistry?

It would have the same net effect as in the first example. The downside would be that if they had time off they would cease to earn of course. But the MASSIVE upside would be that they could begin to earn more very soon. All that needs to be done is to learn the necessary skills that allow you to be remunerated to the standard you deserve as a dentist.

You can use the extra income to drop a day a clinic and have more time.Assets are the slow train to passive income – they can be done but take time.Understanding the skills required to be a HIGH CASH FLOW dentist can be learned pretty quickly with a little help. That’s the quickest route to having more time to do the things you love TODAY.

Enter your details above to receive a link you can use to download your FREE pdf

Read More

Here's What New Associates Need To Know

What Is Your Definition Of Retirement?

How Often Do You Look Back On Your Life And Think “I Wish That I Knew Than What I Know Now?”

Can I Invest In My ISA For Passive Income?

The Role Of Luck In Investing