How Can I Protect My Wealth Against Inflation?

Inflation is the number one passive wealth killer

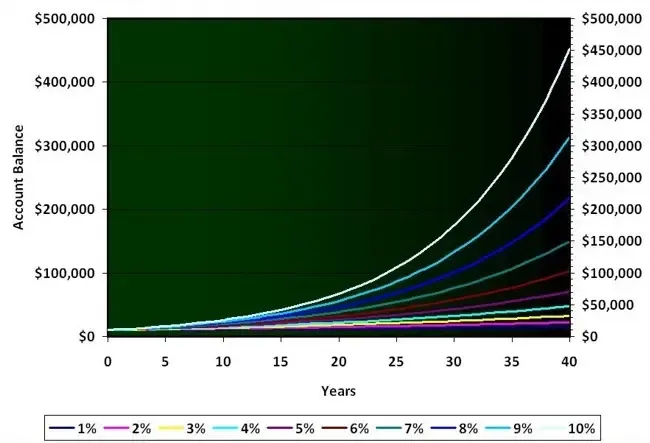

It's the reason why it's simply not an option to keep all your money as cash long term. One of the main functions of investing is actually defense—to protect your wealth from insidiously losing value year on year when stored as cash. We can simply think of investing as transforming your cash into other assets—assets that not only retain value long-term but also grow in value.

The biggest mindset flip is to see investing as a protective measure vs an aggressive measure. We are simply attempting to protect the wealth we have already accrued and allow it to maintain its value/grow

So, we know that we MUST do something but what can we do?

Here are three ways you can protect yourself against inflation. Number 1 is the most commonly touted – Numbers 2 + 3 are also options that get much less airtime but are very powerful when used correctly

1. Invest in assets

This is the obvious one – a well-selected, solid portfolio of assets will outpace inflation. Many see assets as volatile and inherently “risky”. Whilst volatility is a factor one needs to consider – the general growth trend of specific asset valuations is upwards. Asset blend/portfolio composition is beyond the scope of this article. The key takeaway is simply to understand that when done well this protects against inflation. Please take financial advice if you are uncertain about which assets to select.

2. Increase your cashflow

Anything that causes your cashflow to rise is actually inflation-busting as well. This is because when your cashflow rises at a rate that is above the rate of inflation this means there is a “real terms yield” of sorts. A good example of this can be in a business – tweaking a few things to increase your income is necessary to protect against invariably rising costs. Sometimes I see people focus too much on investing in assets without appreciating that this is also an option

3. Invest in knowledge

Again, an unconventional one – however equally powerful. The more skills you have/ the better you are at your skillset is linked to higher income. Stack these enough times and the income you receive from this will bust inflation. The process of investing in these can also be tax deductible as well depending on what you learn. Of course, some dislike the intangible nature of making these sorts of investments – there are more than a few variables contributing to whether or not they are successful. However, it is good to know it’s an option

If you ask me – it's important to blend all 3 of these options to get the best results. You can use this to your advantage and stay ahead of the game to bust inflation

Enter your details above to receive a link you can use to download your FREE pdf

Read More

Here's What New Associates Need To Know

What Is Your Definition Of Retirement?

How Often Do You Look Back On Your Life And Think “I Wish That I Knew Than What I Know Now?”

Can I Invest In My ISA For Passive Income?

The Role Of Luck In Investing