The amount of income protection cover that you can take, is based on a percentage of your income, which varies by insurer, typically in the range of 50 to 70%.

As a sole trader, your income is your annual pre-tax profit, which would be declared on your tax return, so is fairly easy to determine and is essentially, all of your earnings, less your costs.

If you decide to put your income through your own limited company, for tax efficiency reasons, it is very likely that a proportion of your earnings will be left in the company as retained profits, to avoid the tax liability triggered when taking money out.

Your income, from an insurers perspective, is likely to consist of any salary that you take, plus your dividends, which can be significantly less than your total earnings.

This significant reduction in official income, can easily lead to a situation, where you don’t qualify for the amount of income protection cover that you are paying for, so you wouldn’t receive a full payout, if you were unable to work.

The vast majority of insurers do not include retained profit as an allowable income, when calculating maximum cover levels, including Wesleyan, which appears to me to be the most popular insurer with younger dentists, so the current trend of dentists moving out of the NHS work and switching to fully private work & Ltd Company structure, is potentially building up a financial risk that dentists may be unaware of.

Practical example:

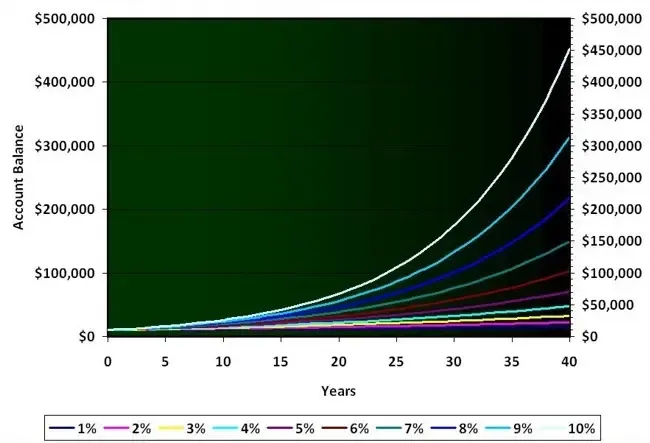

- Sole trader Dentist ‘X’ with an annual profit of £100,000 and income protection of £4,000/month with LV, well below their 60% of income limit or £5,000/month for this income level.

- Dentist ‘X’ starts working through his/her own limited company…

- Takes £12,500 annual salary and £37,500 in dividends, so no income tax and no reduction in child benefit payments, keeps £50,000 in business as retained profit.

LV now sees an income of £50,000 with a maximum monthly covered allowed of £2,500/month and not the £4,000/month expected and being paid for.

Very few income protection providers include retained profit as allowable income, so if you are considering, or have already gone limited, speak to the Income Protection Specialist at MediDent FS and make sure you don’t accidentally invalidate your income protection cover.

The other important thing you also need to know which providers are compatible with limited companies which we covered here.

Enter your details above to receive a link you can use to download your FREE pdf

Read More

Here's What New Associates Need To Know

What Is Your Definition Of Retirement?

How Often Do You Look Back On Your Life And Think “I Wish That I Knew Than What I Know Now?”

Can I Invest In My ISA For Passive Income?

The Role Of Luck In Investing