Whether an associate should be ltd co vs sole trader is certainly a matter for debate amongst dentists (and it's not just a simple as what will reduce your tax bill the most in the here and now)

Like anything in life - we have to understand how something works to truly take command of it. It’s also necessary to understand what's changed recently to ensure we are up to date...

Naturally nothing we can ever say is substitute to advice from a reputable dental specialist accountant:

But here's a little breakdown of some of the pros and cons associates need to know to make the correct choice for themselves:

PROS

- Enhanced Tax Flexibility: A limited company structure offers greater control over your income and how it is taxed. Various tax planning opportunities become available, potentially reducing your overall tax liability.

- Financial Control and Student Loans: Unlike self-employment, where the personal allowance begins to reduce once you hit £100,000 in income, a limited company structure offers more flexibility. You can strategically manage salary and dividend payments, taking advantage of lower tax rates and allowances such as the dividends allowance.

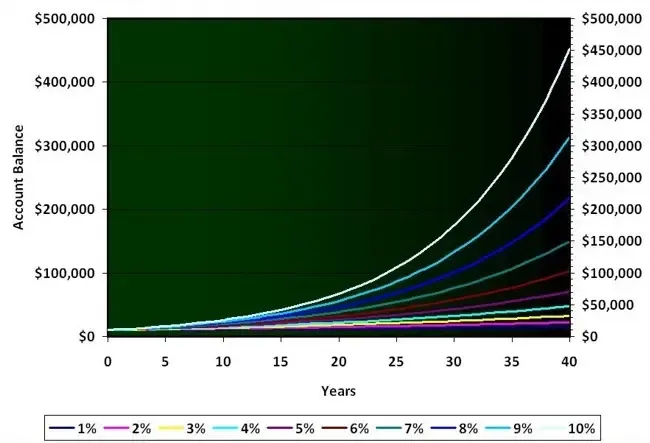

- Investment and Growth Opportunities: A limited company allows for greater savings within the business, facilitating reinvestment for future growth.

- Pension and Expense Advantages: Furthermore, corporation tax liabilities can be reduced significantly through strategic investments in pensions (e.g. SIPPs), purchase of business assets (e.g. electric cars), and allowable business expenses.

- Additional Tax Savings Opportunities: Several additional strategies can be employed to optimise tax efficiency. For example, family members may contribute to the limited company, performing roles such as administrative support, and receive a market-rate salary.

CONS

- Loss of NHS Benefits: Switching to a limited company structure for all your dental income means you will no longer be eligible for NHS Superannuation contributions.

- Increased Administrative and Financial Cost: Running a limited company involves significantly more administrative work, including accounting and payroll which translates to higher accounting fees.

- Use of Losses: Another potential tax implication is that when a limited company makes a loss, it can only use that loss against its own profits.

Full credit to accountant Amman Sarkaria for the above summary. For a full breakdown of each of these pros and cons, Amman has kindly created a downloadable ebook. You can get a copy here.

Enter your details above to receive a link you can use to download your FREE pdf

Read More

Here's What New Associates Need To Know

What Is Your Definition Of Retirement?

How Often Do You Look Back On Your Life And Think “I Wish That I Knew Than What I Know Now?”

Can I Invest In My ISA For Passive Income?

The Role Of Luck In Investing