That’s what most of the wisdom on websites like Reddit would say… And even some of the greats of investing are big fans of this strategy as well (Warren Buffet for one)

But, like most things in life, it would be nice if it were that simple. Here are some things that are relevant and are important to consider. The first thing to do is define the S&P500 (SPX). A simple way to think of it is the average valuation of the top 500 biggest companies based in the US (not quite how it's calculated, but a straightforward way to understand it in principle).

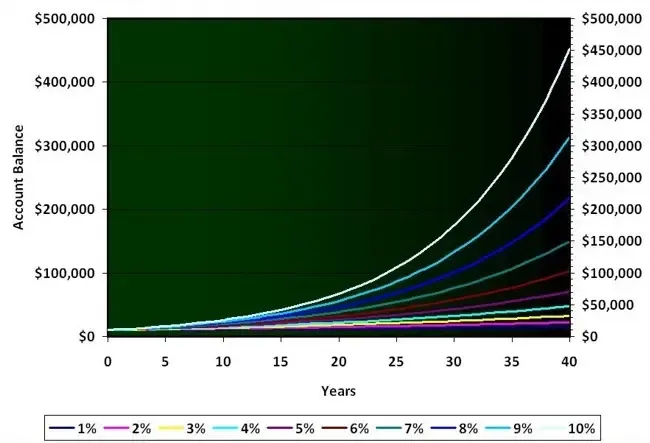

Because this index has historically averaged good growth (9.6% annualised since 1956) it has its numerous vocal proponents… Let’s dissect if such a strategy is sensible: in this case when it comes to following/not following the crowd’s wisdom, the first thing to think of is “What is my goal?”

You see the thing about the S&P is that it's represented by 100% shares in companies (equities). This might sound like stating the obvious but it's important to reiterate. Sometimes, if your goal is to draw profits in the relative short term (let's say less than 10 years)… then the volatility of stocks must be considered. A sudden dip in value can mean a massive amount of difference in the size of your portfolio.

This is the first reason to be wary. In such a situation, it may be arguable it is necessary to water down a portion of your portfolio wish a less volatile asset such as bonds. Collectively, stocks and bonds are known as paper assets. Indeed, you might argue that paper assets are not your priority at all in SOME instances. It is possible, however for most it is sensible they play a part.

Understanding the full field of play and that there are other options available is the second reason this may not be the best approach. In a situation where paper assets are suitable, (take financial advice if you are unsure) the whole premise that the SPX is superior is based on the assumption that America will continue to outperform. If America is already responsible for 60% of the valuation of the world's stock market… then what are the odds it will continue to outperform and grow bigger in relative terms? This would mean that it would continue to eat up more and more world market share.

Above are three good reasons why this may not always be a smart strategy. And as such, may not be the right one for you (despite what one may frequently see out there on the internet). Of course, I would like to make it clear I am absolutely not advocating any one method here over the other in the text above. I really think if one is uncertain they should definitely consult a professional

I’m just simply pointing out some things its important to know when it comes to money.

– James

Enter your details above to receive a link you can use to download your FREE pdf

Read More

Here's What New Associates Need To Know

What Is Your Definition Of Retirement?

How Often Do You Look Back On Your Life And Think “I Wish That I Knew Than What I Know Now?”

Can I Invest In My ISA For Passive Income?

The Role Of Luck In Investing