This is certainly the hand me down wisdom that pervades from our parents/seniors… but is it universally the right thing to do?

In my opinion not always. There’s a multitude of factors to consider, Here are three reasons its worth considering your options before making any decisions… (Definitely not a comprehensive list – there are 100’s of others. Just some things to consider)

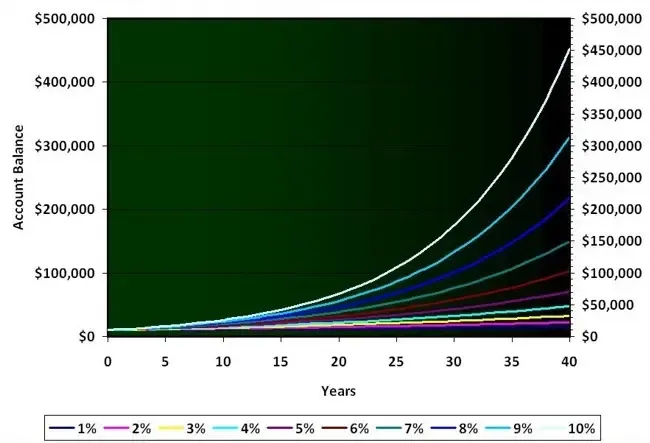

- Pensions lock your capital away I get this might sound obvious however, when investing in a personal pension, there is no means to access your capital until you are of pensionable age. Should you wish to be someone who wants immediate term access to your capital (say for a deposit on a dental practice) then this is not possible. A well run business is unbeatable for cashflow therefore if a huge amount of cashflow is a priority to you then a pension is subsequently less so.

- Life time allowance (LTA) Whilst it is true that there is currently no tax penalty for contributing as much as you like to your pension pot over time… this was only recently removed. When the life time allowance was introduced to pension pots in 2006 it was originally £1.5million. This means that any pension balance over this amount has an additional tax levy upon withdrawing. Yes, concessions were made for those who had already went over this max by this time. However they were only limited and certainly did not mitigate all charges for those in that position. They government reshuffled the deck massively overnight and there was not much those affected could do as there money was ALREADY in the pension. For me it is a matter of time before the LTA is re-introduced. Start contributing to your pension too early and you run a greater risk of increased tax charges when you reach pensionable age.

- Restricted investment options Your ability to gain exposure to gold, property, privately own firms or crypto is limited in pension accounts. Yes it is possible, but has certain restrictions. Should these assets appeal to you for whatever reason – then a pension is less likely to be your account of choice. Its really worth considering the properties and characteristics of the asset you are purchasing to see if they are aligned with your objectives.

Now for the record I am DEFINITELY not saying a pension is not a good idea. There is no issue whatsoever with it being partly or even exclusively utilised the investment vehicle which you choose for your journey to financial freedom. It just really helps to know the above information before one locks away a portion of their money for a significant amount of time.

Really hope that helps.

Dr. James

Enter your details above to receive a link you can use to download your FREE pdf

Read More

Here's What New Associates Need To Know

What Is Your Definition Of Retirement?

How Often Do You Look Back On Your Life And Think “I Wish That I Knew Than What I Know Now?”

Can I Invest In My ISA For Passive Income?

The Role Of Luck In Investing