The Election is over and we have a result!

What does that mean? More change? We’re certainly expecting change in some areas, but perhaps we may not see as much as we might imagine, at least not immediately.

Let’s look at what might be in the new government’s mind, and where it sits right now. During the election campaign, Labour didn’t need to announce lots of new details because they were well ahead in the polls and confident, so it wasn’t necessary. Sure, there have been a lot of broad promises of public services, education, the NHS. We heard that recurring phrase: ‘fully costed, fully funded’, but it wasn’t completely spelt out over what length of time the funds were to be raised and the costs were to be spent. Now, we must appreciate that it will take some time for the new ministers to understand and get to grips with the practicalities of the levers of government and how one thing affects another. In particular, the government’s income – tax – is currently based on the previous government’s plans, which held quite a different shape.

So whilst lots of things may be planned, the simple truth is that there will be a lag between the raising of funds (ie tax), and the delivery of them. The new government will, however, be anxious to be seen making the changes, so there will inevitably be a magnifying glass run over the tax system. Tax dodgers, Non-Doms and VAT on school fees can only produce so much extra revenue.

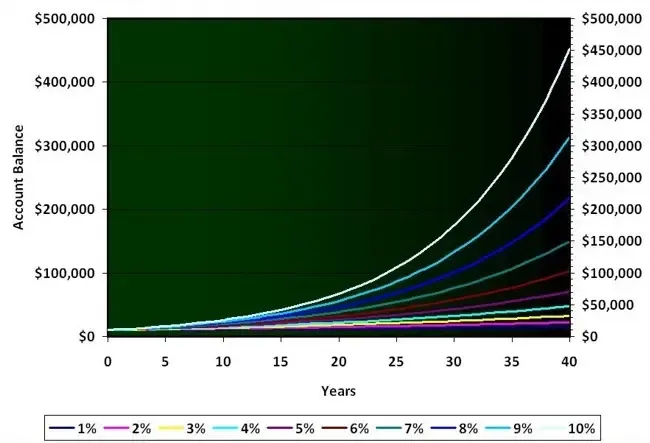

The repeated cry for economic growth, evident even in the King’s Speech in Parliament, is because growth produces more income for the country and consequently more tax ….. the least painful option for all concerned. Otherwise, the income needed to fulfil the government’s promises must come from raising extra taxes.

After such an Election result and the stability that comes from it there will almost certainly be a bounce in the economy – even a hopefulness – which will provide some impetus to the desire and drive for growth. Will this mean that tax increases can be avoided?

There was a promise not to increase income tax, but this is a very broad and blunt statement. Which bit of the income tax system? ‘Income Tax’ doesn’t affect everyone equally. Even if rates remain constant, there are lots of other moving parts that can be changed, and which could raise additional tax from the same income tax pot. A very obvious example is a restriction of the tax relief on pensions, or restricting the annual ability to contribute. Scrutiny of this area with a view to increasing the tax take is very likely, and almost invisible to the public at large unless you are caught in it – which of course higher-earning NHS dentists will be. But given that one of the new government’s political priorities is to fulfil a promise of more NHS dentists (and doctors), who would be discouraged by this, would the new Department of Health not prefer to keep them onside and leave their superannuation relief alone?

Capital gains tax is the other subject around which there has been much discussion. To remove the lower 10% band would fly in the face of all Labour have said about encouraging businesses to start up, to grow, to provide wealth in order to create employment. There has always been a lower rate to reward entrepreneurs who have taken risks to start a business and who then come to retirement. This will surely continue, but when governments have changed in the past, they have reinvented this under a different name, and with different rules. Plus ça change.

However the normal rate CGT of 20%, outside the ‘retirement’ scenario, is the area where we might see some movement. Bringing it more in line with other income tax rates has been a conversation topic for some years. But which income tax rate? To move it from 20% or the residential rate 28% to the higher 40% – doubling it in some cases – is a massive change and the potential for unintended consequences is wide. For example, if a large number of investment properties, which many successful dentists have, were suddenly dumped on to the market prior to the rate increase, this would depress the prices – just at the time the Government is trying to persuade developers to invest in building more houses.

Again, this would be against the pro-business statements they have made in recent months. Generating tax revenues has to be balanced against the loss of business trust that would accompany many of the changes currently mooted.

There are certainly some easy changes possible in the imposition of tax which would be not hugely visible to the population at large, but would be felt by dentists. But Labour will understand that one of the reasons the Conservatives were dumped is that they made us feel poor. Increasing the tax burden on dentists does not reverse that. Many will hope that the new regime will make changes within a political framework which will overall permit us to feel less poor, and will support our industry.

– Johnny Minford Commercial and Development Director of DJH Specialist Dental Accountants

For more questions/inquiries, feel free to contact me directly at johnny.minford@djh.co.uk

Enter your details above to receive a link you can use to download your FREE pdf

Read More

Here's What New Associates Need To Know

What Is Your Definition Of Retirement?

How Often Do You Look Back On Your Life And Think “I Wish That I Knew Than What I Know Now?”

Can I Invest In My ISA For Passive Income?

The Role Of Luck In Investing