Fundamentally we can actually distil the forces that govern our success in investing down to 3 things:

- Rate of appreciation.

- Inflation

- Volatility

So, what do these mean?

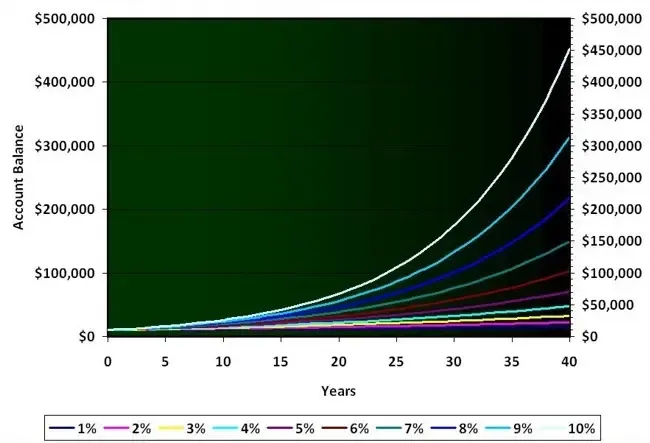

- Rate of appreciation: This is pure and simple a function of time and increase in value. The more our assets appreciate and the shorter a timeframe over which this occurs is the greater the rate of appreciation. The higher the better, however we must counterbalance this via choosing assets with a proven history of achieving returns. The more data the better in yields a more secure track record.

- Inflation: This is the floodwater that is constantly rising and attempting to drown out our portfolio value. The faster this rises the more of a chance that we may find ourselves underwater. The whole idea is to choose assets that will outpace inflation or else we never actually make any profits.

- Volatility: Volatility has a few different academic definitions however it is in essence the amount the assets valuation varies around its mean over a given unit of time. The more volatile the asset the more we have to consider timing when extracting returns from the asset.

The essence of investing is threefold… The idea is to obtain the greatest rate of appreciation over the shortest amount of time minimising volatility and outpacing inflation by the greatest rate possible.

There are a few more factors to consider of course. However, understanding that there are only three main forces at play is a significant first step.

Enter your details above to receive a link you can use to download your FREE pdf

Read More

Here's What New Associates Need To Know

What Is Your Definition Of Retirement?

How Often Do You Look Back On Your Life And Think “I Wish That I Knew Than What I Know Now?”

Can I Invest In My ISA For Passive Income?

The Role Of Luck In Investing