Great question – and really “the best” can only be defined relative to your overall objective.

For the purposes of this article we will keep things simple and talk purely about financial investments. Specifically traditional paper assets (stocks and bonds) which form the backbone of the retirement planning of most individuals.

We’ll also define long term investment as over 10 years. This is the most common timeframe for retirement planning. So let's look at the vehicle that the historical data would say has delivered the highest returns.

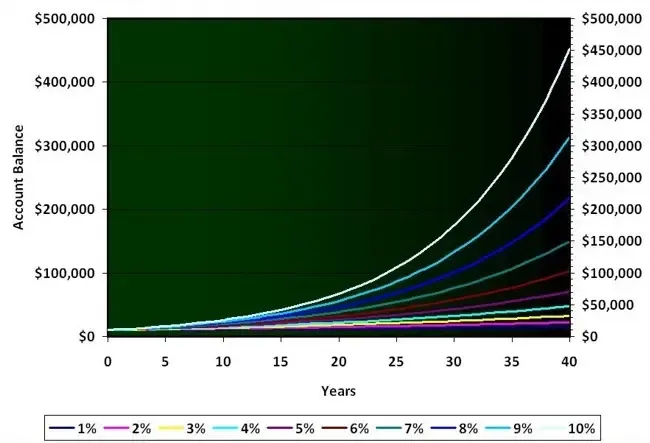

This would correspond to accelerating the date at which we can retire. If retirement is defined as the point at which we start CHOOSING to work rather than feel obligated to… then the sooner we have this the better. Hence the more we accelerate this the better.

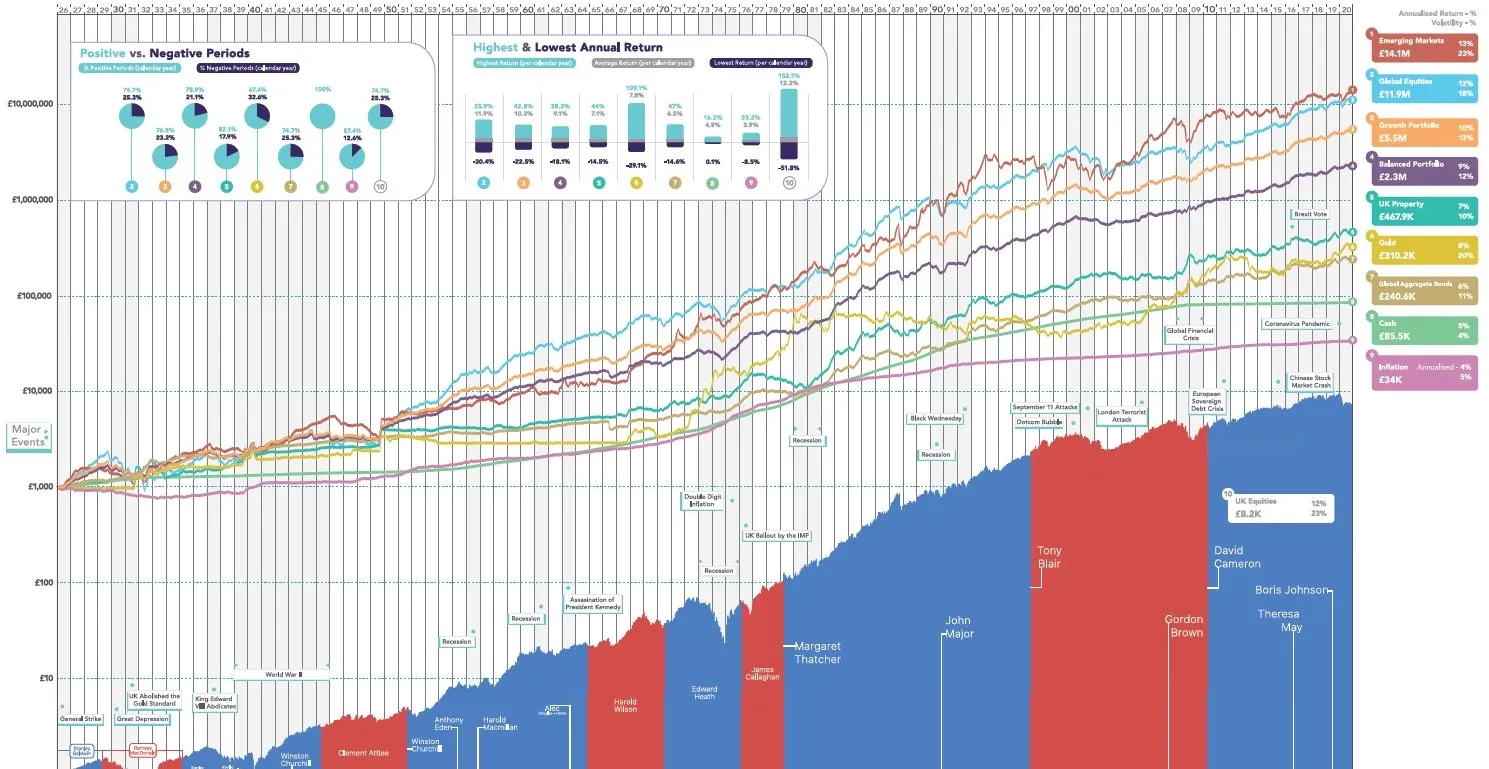

The graph above is interesting because it shows the growth in value of various asset classes since the year 1926. You can see world equities have been the asset that has spent the majority of the time at the top. Of course there is no guarantee that this will always be the case. However we certainly want the data on our side when it comes to such decisions.

If you can take emotional factors out of your investing and have a long term timeframe this is useful to know. Of course there are a few more factors to consider when it comes to designing a portfolio for your retirement.

But its a good place to start.

Enter your details above to receive a link you can use to download your FREE pdf

Read More

Here's What New Associates Need To Know

What Is Your Definition Of Retirement?

How Often Do You Look Back On Your Life And Think “I Wish That I Knew Than What I Know Now?”

Can I Invest In My ISA For Passive Income?

The Role Of Luck In Investing