With interest rates going up monetary supply has been decreasing. A relative scarcity of money will mean less free capital pouring into the markets therefore is a factor in temporary declines. Also institutions will seek to divest portions of their portfolios from “risk” assets (usually stocks) and will be enticed to invest in bonds because of their current higher yields.

This can mean our portfolios are in for a bumpy ride. Question is: How do we handle such a scenario?

Well, whilst I can never give financial advice….…what I CAN do is provide helpful frameworks that you may find useful to aid your decision making.

Here are 3 things that can help you decide:

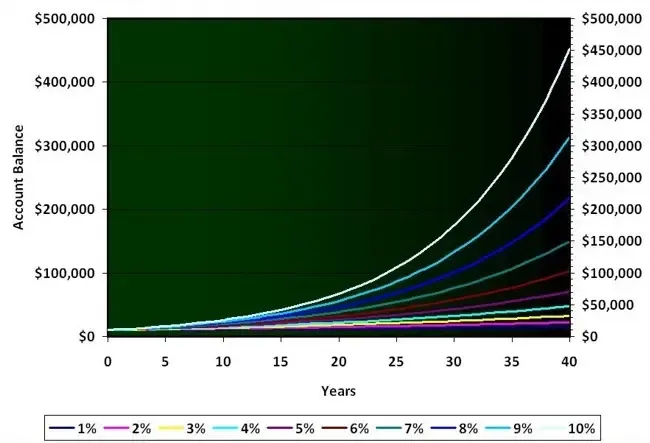

- When do I need this money? The majority of people make investing decisions based on short term thinking. That's a no-no. Typically capital invested professionally in the stock market is done so with the expectation that we can really measure results after at least 5 years. Most people make decisions to sell if they see decreases over a timeframe of weeks, days or even hours. Sometimes the asset we have purchased is perfectly fine however its our execution of the investing process that lacks. If this money is not needed any time soon – then do we need to cash in and sell? That can crystalise the loss meaning we miss out on any subsequent gains. Time IN the markets beats TIMING the markets, as the saying goes.

- What is my overall plan? Really before we make any investment decision we need an overall plan… It's only when we know the destination that we can select the correct vehicle? (asset) to get there. If things are taking a tank then reverting to your original plan will give you perspective. This will mean we don’t make any kneejerk decisions.

- What is the quality of the asset I’ve purchased? The correct assets have shown consistent growth ever since their inception. They are inextricably tied to the fortune of the global economy and even civilisation itself. Understanding these what these assets are, and building your portfolio around them WILL give you immense mental fortitude in your investments. Then your execution will be UNSHAKEABLE. Much better...

Of course there are many more factors than this in our decision making – these are just 3 pertinent examples.

These 3 will help you make decisions from not from a place of emotion but from a place of logic. Happy investing.

Enter your details above to receive a link you can use to download your FREE pdf

Read More

Here's What New Associates Need To Know

What Is Your Definition Of Retirement?

How Often Do You Look Back On Your Life And Think “I Wish That I Knew Than What I Know Now?”

Can I Invest In My ISA For Passive Income?

The Role Of Luck In Investing