The power of compounding is wild…

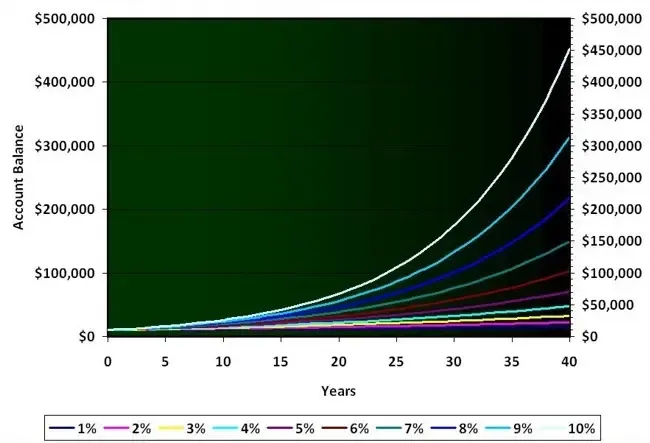

Not least the massive effect it has on the size of our portfolio long term. The chart below shows the outcome of various rates of returns of an initial $10k investment at 5 year increments. The currency unit is arbitrary and could also be replaced with £s

As you can see from the chart, an account which has an initial investment of £10k and a rate of return of 10% will compound to £450k in 40 years. A 45x return on your initial capital. This is from a one off investment of £10k and no further contributions. Realistically, most people contribute continuously and not just as a one off meaning the effect would be amplified and thus even greater.

You can see that even a 1% reduction in returns (equivalent to a 1% ongoing fee) leads to a portfolio of £300k and NOT £450k. That’s a £150k opportunity cost over this time period.

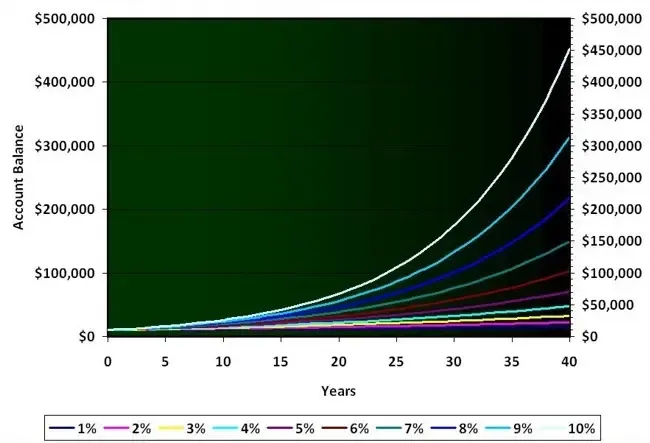

Profits are the gap between the returns on our portfolio and the fees we pay. It stands to reason that the greater our returns and the more minimal our fees is the more profit we make. And hence the sooner we hit financial freedom.

10% returns per annum is not far off what is reasonably attainable in an investing account with a little education

And a the majority of portfolios can be optimised to around 0.5% fees per annum

However, a huge amount of the UK’s portfolios are not attaining this. And I feel not understanding what’s possible/where the bar can actually be set is a big part of this. The chart below shows what is at stake.

40 years may sound like a long time – however if you start working as a dentist at 25 and retire at 65 which is not outside of the ordinary… then its pretty representative of a typical career.

There’s a MASSIVE margin of return potentially on offer here… (and certainly much more than there would be purely by leaving the cash idle in a bank account)

Of course there are situations where this doesn’t apply. And also a little knowledge is needed to pull it off...

DIY investing is not for everyone – and some people prefer to have professional guidance. But understanding how much some education will benefit you and is likely to unlock that extra 2-3% in your investment portfolio is so important. The chart below shows what there is to be gained.

This can pull your financial freedom date forward by years of even decades. Food for thought.

Enter your details above to receive a link you can use to download your FREE pdf

Read More

Here's What New Associates Need To Know

What Is Your Definition Of Retirement?

How Often Do You Look Back On Your Life And Think “I Wish That I Knew Than What I Know Now?”

Can I Invest In My ISA For Passive Income?

The Role Of Luck In Investing